#2 S&P500? How about the S&ME500

Why investing in yourself may be profitable in the long run than investing in the stock market.

Yes I know, it’s a corny title.

You and I might very well be in the same boat now, confuzzled about the current economic situation. Some gurus on Twitter calling for the ‘worst bear market in history’, while others are screaming ‘Fed pivot incoming!!’

Well, instead of thinking whether to long or short the market, I’m here to tell you that you have a third option! Instead of investing $500/month into the S&P500 to generate an unknown percentage return, why not invest in the S&ME500 for an exponential return on your time and money? (Credits to Alex Hormozi for coining this phrase)

The truth about the financial system is that it has proven itself to be fragile and fail under pressure.

Recall the 2008 Great Financial Crisis where investment banks overleveraged on mortgage-backed securities and got wiped out. Sure we had a 12-year bull market after that, but the US’s debt-GDP has only ballooned since then. (It’s at about 130% now, and Reinhart and Rogoff’s review of world history since 1800 shows that economies whose government debt exceeded 90 percent of GDP over a prolonged period have realized much slower economic growth than less-indebted countries.) We all know what happens when an individual incurs excessive debt, let alone an entire country.

Instead of investing $500 a month into the stock market, one strategy I have been practising is to invest in memberships that allow me to maximise my exposure to people I aspire to become.

I realised over the years of paying for my monthly gym membership that I was putting myself in an environment with like-minded people.

For two years I shunned starting conversations with people in the gym, until one day I decided to muster the courage to speak to a few gym regulars.

Unknowingly, I ended up speaking to the owner of the gym franchise himself. He shared about his journey in business, from starting many retail stores back in the day and subsequently using the profits to:

Invest in other businesses

Pay off debt

Hold cash for rainy days.

(shoutout to Ryan if you’re reading this)

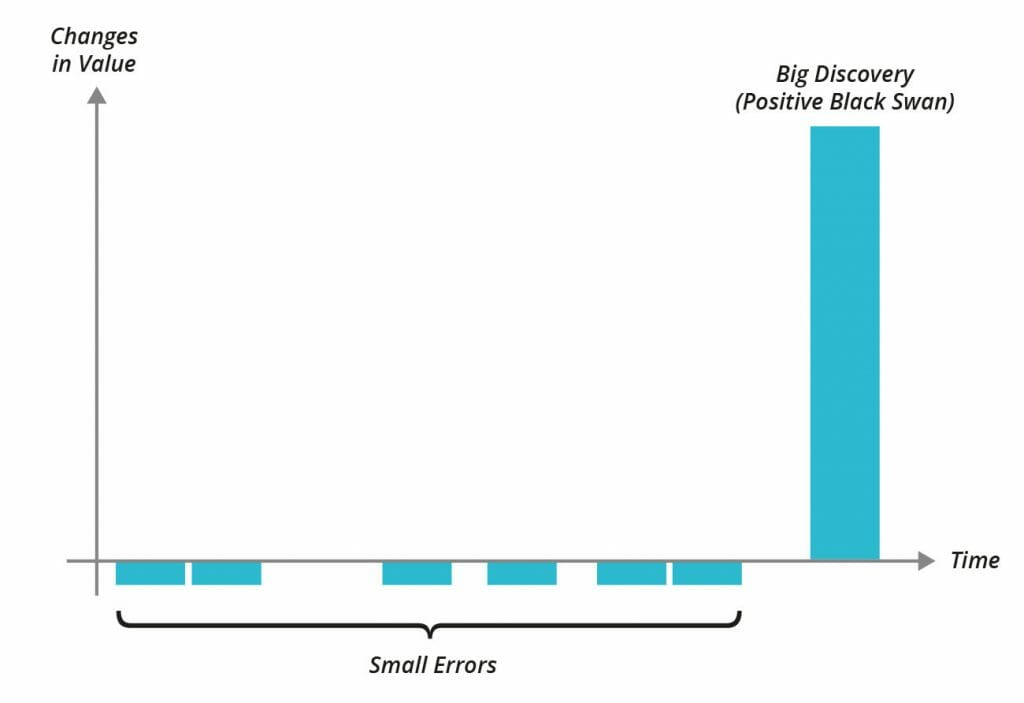

It dawned upon me that the years of non-interaction with anyone in the gym before speaking to a successful business owner and gaining valuable insight that changed the way I viewed business, was actually an Extremistan event. (small losses before large outsized payoff = monthly gym membership fee led to invaluable life advice)

And so I highly recommend anyone getting into the self-education game, to join communities of people with similar interests as you. You never know what you might get, the ‘worst case’ is paying a monthly fee for doing something you already enjoy, and the best case? Well, meeting someone that might just change your life for the better.

From calculating how large an IRR I should target to retire early, I am now quantifying my investments in terms of how I FEEL after the experience, and also whether I have derived value from the information provided or the advice imparted. Most importantly, I will give it time so I can maximise my exposure in these positive environments. My philosophy moving forward can be summarised below:

And so to end off, as much as possible, stop putting your trust in the financial system. The people running it don’t care about making you rich, only themselves. Put YOUR trust in YOU. I’m rooting for you.

Sean